The Advanced Air Mobility (AAM) industry is set to grow to USD20.8 billion by 2035 at a CAGR (compound annual growth rate) of 22.1%, according to the latest Drone Industry Insights report.

The following are extracts from the report description:

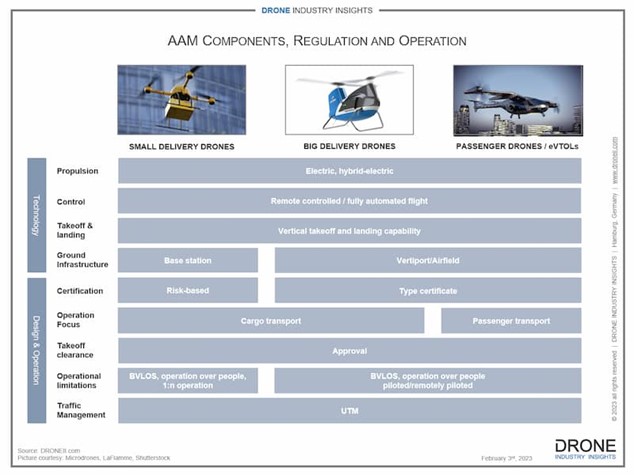

“With over 600 concepts from over 350 companies, the AAM space is rapidly growing. Currently, 5% of these concepts are in the test phase, which is the preliminary stage of the certification process. To be widely accepted for use in densely populated areas, eVTOLs must meet several important requirements, including safety, noise reduction, efficiency, cost-effectiveness, and eco-friendliness.

In terms of weight, eVTOLs aim to be much lighter than traditional helicopters, despite the added weight of batteries. Most manufacturers are targeting certification under FAA Part 27/29, with a maximum takeoff weight of 3,175kg and the ability to carry up to nine passengers. Range is a central point of discussion in the eVTOL industry, with manufacturers aiming for ranges of up to 500 km, although the required specific battery capacity does not yet exist. On average, manufacturers aim for four-seat eVTOLs – comparable to a private car.

Drone delivery: small and big cargo

“The first drone deliveries to take off have been those carrying medical goods. They are proving to be transformative for under-developed countries like Rwanda, Ghana, Vanuatu, and soon India and the Democratic Republic of Congo test and conduct medical drone deliveries. In more western countries, Switzerland has employed them for two years, testing organ transplant deliveries while several countries have already enjoyed food deliveries by drone including Iceland, Finland, Australia, the United States and many more. Finally, as e-commerce and postal service giants like Walmart, Amazon, Rakuten, JD.com enter the drone delivery market, retail goods and industrial materials are beginning to be delivered by drone.

When there is no or strongly limited access to infrastructure, big cargo drones offer most value. Transporting cargo to remote places (e.g. off-shore oil rigs, islands, etc.) often requires slow and costly solutions. Large cargo drones can leapfrog the price-intensive construction of ground infrastructure (e.g. a new road, train track or ferry slips) and deliver goods directly to the point of consumption. However, the combination between direct, first-mile/last-mile, mid-mile/feeder, and hub forwarding will be a key component for the logistics and success of drone delivery.

Vertiports and landing pads

There are several types of ground infrastructures such as: drone landing pads/stations, drone cargo hubs, verti-pads/verti-stops, verti-hubs and AAM-bubs, all of which have different capacities and fulfill different needs for eVTOLs and delivery/cargo drones. Among the top issues to consider are location, noise mitigation, power supply, maintenance, and any additional value to society that the vertiports would bring (e.g. shops, food, etc). This is perhaps one reason why all existing requirements for vertiport design are currently published as draft versions rather than complete regulations.

For more information

The Vision of Advanced Air Mobility: eVTOLs, Drone Delivery, Vertiports and UTM